7 Examples of Opportunity Costs. Opportunity cost -3000.

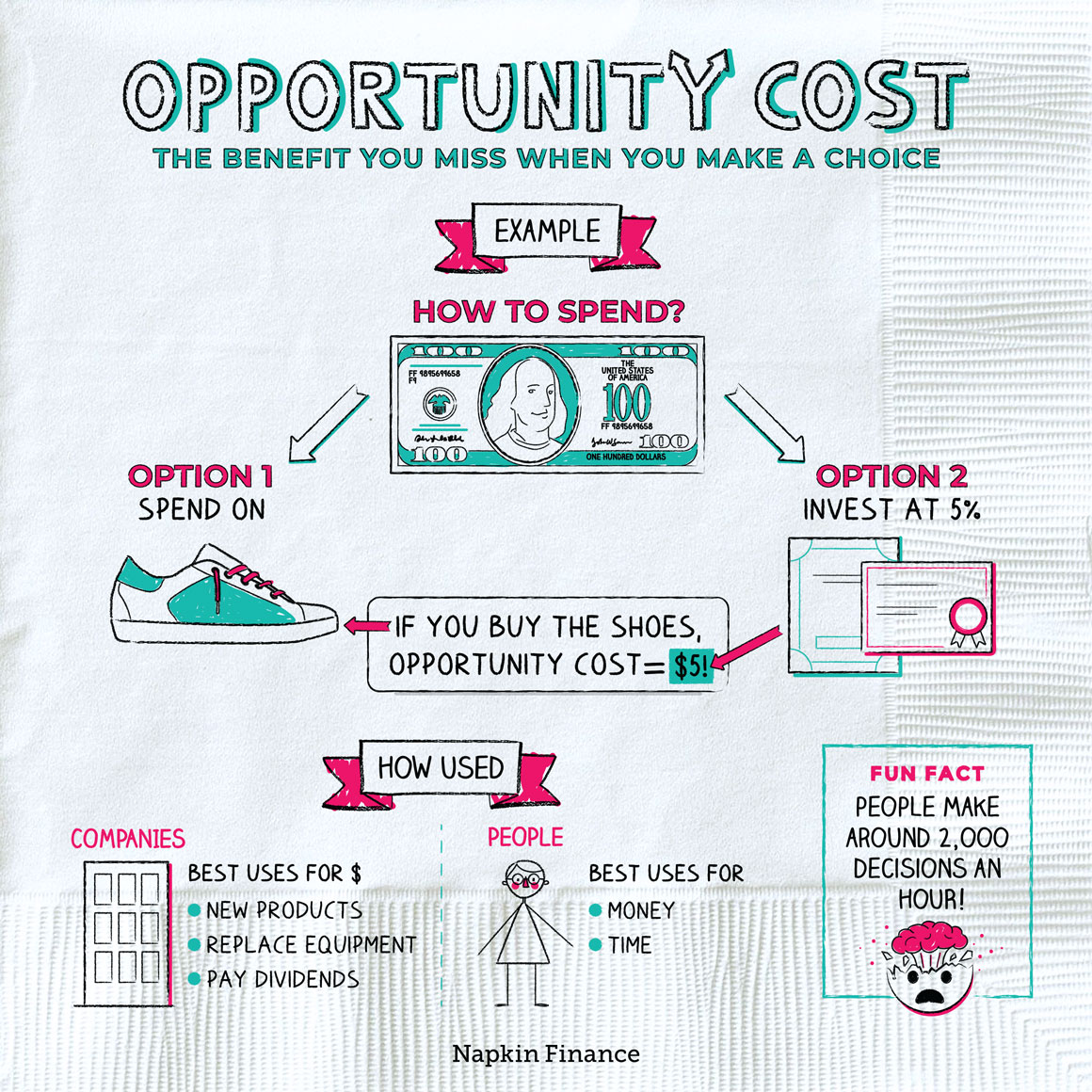

What Is Opportunity Cost Investment Opportunities Napkin Finance

Opportunity cost Return on the option not chosen - Return on chosen option.

. It is the sacrifice related to the second best choice available to someone or group who has picked among several mutually exclusive choices. The opportunity cost is planting a different crop or an alternate use of the resources land and farm equipment. He is faced with several options to spend the prize money.

These comparisons often arise in finance and economics when trying to decide between investment options. To properly evaluate opportunity costs the costs and benefits of every option available must be. Make an informed decision.

Opportunity cost can lead to optimal decision making when factors such as price time effort and utility are considered. Opportunity cost is the cost of taking one decision over another. Heres the reality.

Decisions typically involve constraints such as time resources rules social norms and physical realities. 2000 per year as opposed to Bank. In simplified terms it is the cost of what else one could have chosen to do.

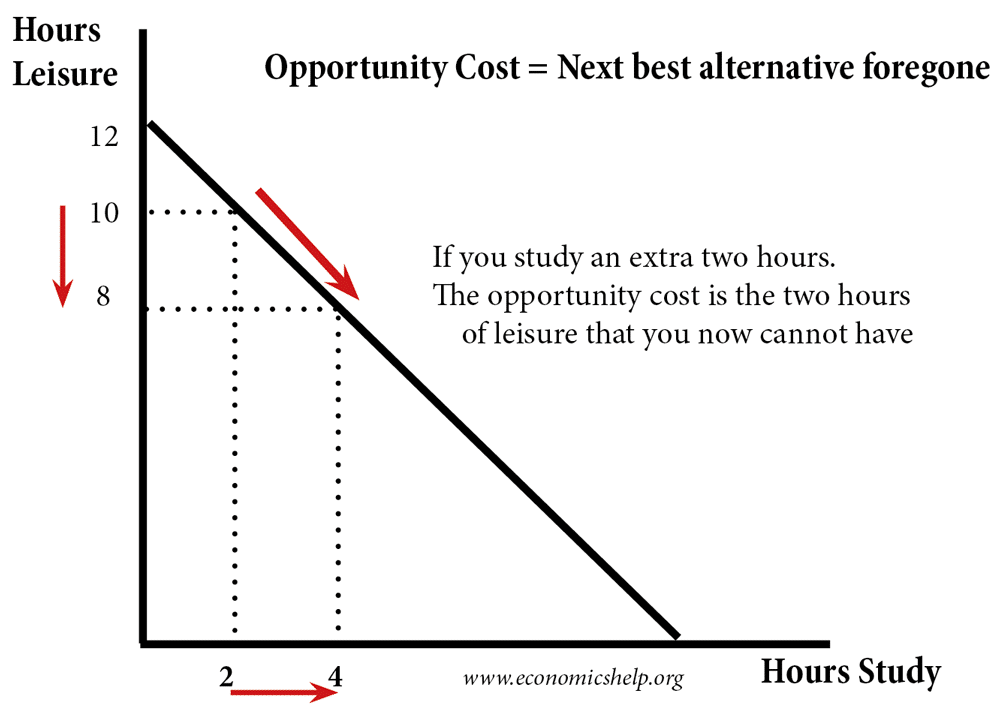

Opportunity cost 32000 - 35000. The opportunity cost is the value of the next best alternative foregone. Opportunity cost is the value of what you lose when choosing between two or more options.

What is Opportunity Cost. Opportunity cost is one of the key concepts in the study of economics and is prevalent throughout various decision-making processes. Harry has won 500 in a lottery.

Create your own example to support your explanation. With the figures from the formula. John Spacey December 22 2016.

In a formula this is. As an investor opportunity cost means that your investment choices will always have immediate and. A simple example of opportunity cost is to let us suppose that a person is having Rs.

Define and describe the concept of opportunity cost with an example. The simplest definition of opportunity cost is the price of the next best alternative that you would have opted for had you not made your first choice. Opportunity cost is the cost of any activity measured in terms of the value of the next best alternative forgone that is not chosen.

A loss of personal gain when choosing an alternative. Does money have to be involved when you talk about opportunity cost. Every single thing you say yes to carries an opportunity cost.

Opportunity cost is the comparison of one economic choice to the next best choice. In business opportunity cost may also be referred to as economic cost. View the full answer Transcribed image text.

This is the reason why it is also known as Alternative Cost. Accounting Profit Revenues Expenses 350000 10000025000300005000 190000 However after adjusting for Opportunity costs Economic Profit will be different which is shown below. Opportunity cost FO return on best forgone option CO return on chosen option Say youre considering the opportunity cost of selling your shares in a company at 10000 now versus selling in six months time when the stock is valued to be 15000.

When a person has to give up a little in order to buy something else is called Opportunity Cost. Spending 100 on a new Nike shoe and the opportunity cost is failing to pay for your electricity bill. Definition and Example of Opportunity Cost.

The opportunity cost is time spent studying and that money to spend on something else. Lesson 12 Opportunity Cost and Trade-Offs Key Terms 1. Youd plug those numbers into the formula like so.

A farmer chooses to plant wheat. When you decide you feel that the choice youve made will have better results for you regardless of what you lose by making it. Expert Answer 100 1 rating Opportunity cost refers to the value of best next alternative use of the available resource.

In other words you could be doing something else instead. View the full answer Previous question Next question. Opportunity cost Potential value of option not chosen Actual value of option chosen.

When someone gives up something they have for something else. In general it means having to choose one option. An opportunity cost is the value of the next best alternative.

Lets understand this through the following example. Opportunity cost is a representation of the benefits that a business individual or investor misses out on when choosing one option over another. This is the basic relationship between scar.

Buy an iPhone worth 500. This means you would lose 3000 if you stay at your current job. If you decide to spend money on a vacation and you delay your homes remodel then your opportunity cost is the benefit living in a renovated home.

Why or why not. An opportunity cost is the value of the best alternative to a decision. A trade off between producing more goods for consumers or the military.

Its necessary to consider two or more potential options and the benefits of each. Opportunity cost 1500 1000 500. This cost is not only financial but also in time effort and utility.

A commuter takes the train to work instead of driving. Investing in Company B would have netted you 1500. For each of the examples explain the opportunity costs for each decision.

Doing one thing often means that you cant do something else. Lets say you decided to invest in Company A which nets you 1000. Thus the opportunity cost of this choice is 500.

Opportunity costs apply to many aspects of life decisions. Opportunity Cost Assignment Name_____ 1. Definition The Opportunity Cost is referred to the probable returns from the use of resources that are considered as a second-best option.

At this stage you should know whether or not the financial gains outweigh the costs. The three different financial decisions which are person would make and the opportunity cost are. Economic Profit Accounting Profit Implicit Opportunity Costs 190000- 8000030000 80000 Popular Course in this category.

Opportunity cost is the forgone benefit that would have been derived from an option not chosen. Selling off your crypto investment of 1000 that was expected to increase in value in a months timeThe opportunity cost is the expected profit in one month. If you decide to sell now your opportunity cost is 5000.

The opportunity cost is also the cost as a lost benefit of the. See the answer please describein your own wordsthe concept of opportunity cost. Often money becomes the root cause of decision-making.

Provide an example of opportunity cost from your daily life. 50000 in his hand and He has the option to keep it with himself at home or deposit in the bank which will generate interest of 4 annually so now the opportunity cost of keeping money at home is Rs. Opportunity costs can impact various - and critical - aspects of your life including money career home and family and other lifestyle elements.

Opportunity cost is defined as the benefit that is forgonemissed when one alternative is chosen over another. The opportunity cost attempts to quantify the impact of choosing one investment over another. In your own words explain opportunity cost.

Opportunity Cost Definition Economics Help

Opportunity Cost Meaning Importance Calculation And More

Opportunity Cost Definition 4 Examples Economics Boycewire

What Is Opportunity Cost Investment Opportunities Napkin Finance

0 Comments